Good things are happening here

There is no denying that 2020 is a year that most will never forget. But through it all, there is some good that is happening.

Our industry is showing signs of recovery. In a recently published article, president of the data and analytics division at J.D. Power Thomas King, pointed out that June retail sales were down 6 percent as compared to the J.D. Power pre-virus forecast. That is a significant uptick from May, when retail sales reflected a 20 percent downturn in the same comparison. Some markets are even on track to beat 2019 retail sales.

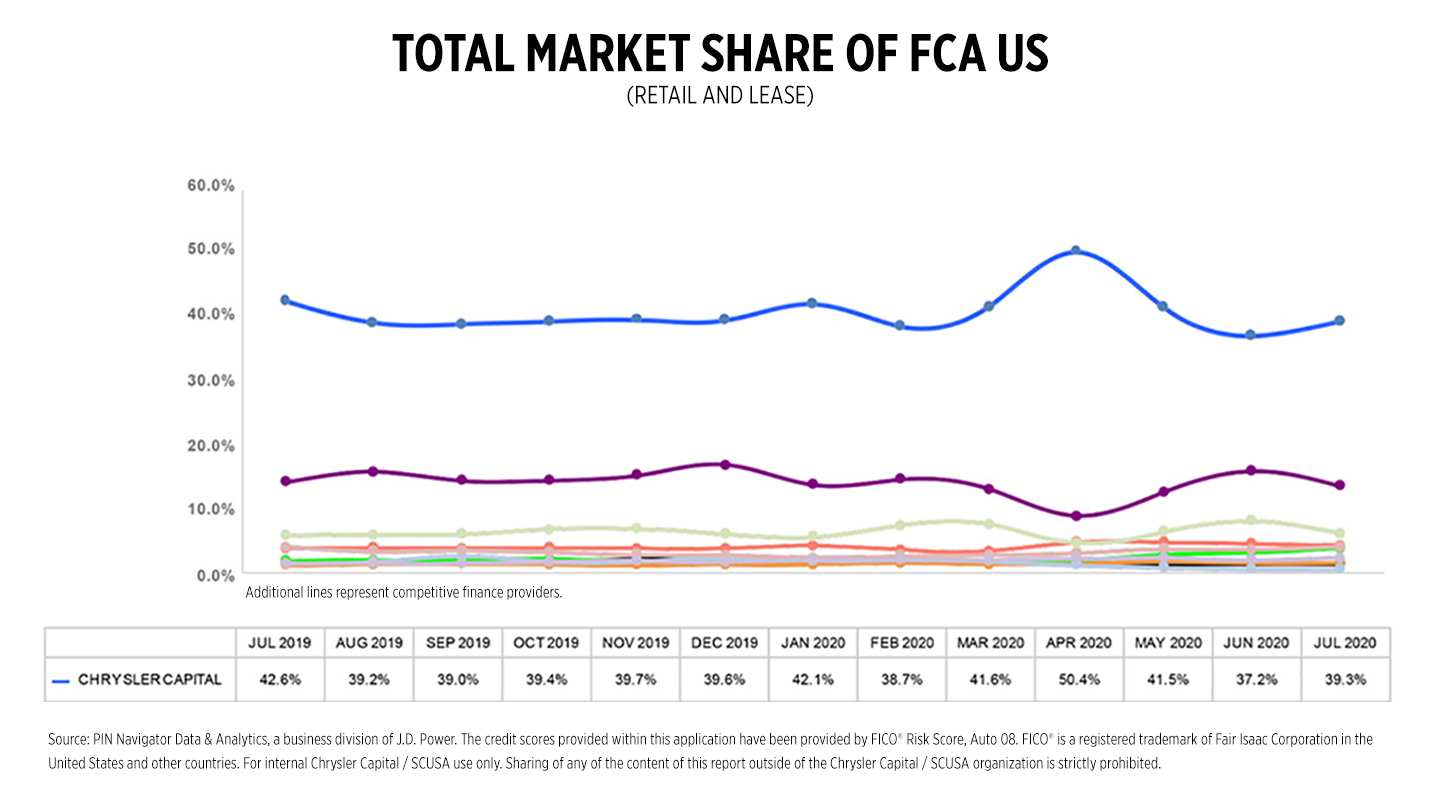

With sales rebounding, Chrysler Capital originations are as well. The second quarter of 2020 proved to be record-setting, as Chrysler Capital reached its highest ever FCA US market share (50.4 percent) in April.

Total Q2 Chrysler Capital loan originations were $4.7 billion (up 36 percent year over year), supported in great part by a significant increase in prime loan volume. This was partially driven by incentive programs that included a $12 million spend on 125 different regional programs over the first seven months of the year.

In addition, $12 million was allotted for CCAP exclusive subprime bonus cash. Beginning in February 2020 and extended through this month’s offerings, subprime bonus cash available on several great FCA US brand vehicles truly provides opportunities for full-spectrum financing to consumers in every credit range.

During the first seven months of 2020, FCA US dealers nationwide have earned $21.6 million from Chrysler Capital VIP. April, again, proved to be a significant month, as the program made the change from being volume-based to penetration-based, allowing dealers to better control their ability to earn. This change proved to work well as, in its first month, a total 78 percent of dealers earned a record-setting $6.2 million in VIP money.

Year over year, we strive to make improvements in every level of service.

Taking a step outside of their regular routines, the Chrysler Capital Dealer Relationship Managers have made the change from in-person dealership visits to communicating virtually. Our objective during this unprecedented time is to help our dealers succeed, so finding the best way to effectively create meaningful visits and maintain our personal connection became a priority.

In our Originations Departments, adding staff, along with training and process improvements, were high on the 2020 priority list. We started by increasing the number of credit analysts by 5 percent and funding analysts by 20 percent. Then, we created a dedicated processing team for the Funding Department to increase daily capacity. But it didn’t end there. We also:

- Automated the completion of targeted verifications for improved funding efficiency

- Merged funding resources to increase the number of agents available

- Enhanced funding training time to promote faster ramp-up production with new staff

- Enhanced credit training to develop industry insight, credit process expertise and optimize the dealer experience

To help enhance outbound communication between funding and our dealers, the dealer communication tool (DCT) was created and put into action.

In addition, we reviewed existing funding policies and made the following changes:

- Eliminated the prefunding customer interview (PFCI) on resubmitted contract packages where the interview was not an original stipulation of the approval

- Began allowing handwritten corrections on all documents resulting in reduced return rates

- Simplified the verification of employment (VOE) process, allowing valid proof of income (POI) to satisfy VOE requirements and eliminating contacting the employer

- Increased GAP maximum to $1,000 (unless otherwise dictated by state law)

- Initiated a digital contracting project to enhance our product offering on Dealertrack

- Implemented remote eSign on RouteOne

- Ongoing discussions with outside vendors to enhance eContracting capabilities

For all our existing finance and lease customers, we understand the effects of COVID-19. We understand that the situation is fluid. We understand that they may still need our help. Our commitment to our customers is unwavering. Whether through our COVID-19 web page, designed specifically to provide information and assistance 24/7, or our customer service agents who are ready to provide support, we care and we are here to help.

Since the need arose, we have granted approximately 730,000 extensions to our retail customers and 70,000 deferments to lessees.

And while we stand ready, the asks for assistance from our customers are on the decline. As reported in the Santander Consumer USA Holdings Inc. Q2 press release, in total the corporation’s 30-59 and 59-plus delinquency ratios are down, as are retail installment charge-off ratios and troubled debt restructuring.

“Our results this quarter demonstrate the resiliency of our portfolio, the effectiveness of the hardship programs we instituted and the strength of our business model,” stated SC President and CEO Mahesh Aditya. “Our employees, dealers and customers continue to be our priority as we endeavor to provide them the highest levels of service in these trying times.”

Chrysler Capital represents financial strength and stability. We have provided competitive programs and full-spectrum support to you, our FCA US dealer partners, for over seven years and you can count on us to continue working hard for your success wherever the economy takes us.

In prosperous times. In uncertain times. At all times. We are here for you.