What can you do to help reduce fees?

We wanted to take a moment to address an important item we collected throughout the J.D. Power Survey process. Many of the comments pertained to the reasonableness of our lender fees, specifically in the nonprime lending space. While fees are a necessity in the subprime space, there are things that you can do to help reduce them.

Chrysler Capital is by far the largest volume lender in this subprime segment. In fact, Chrysler Capital funded 31 percent of FCA sales for applicants with FICOs below 640 in 2016.

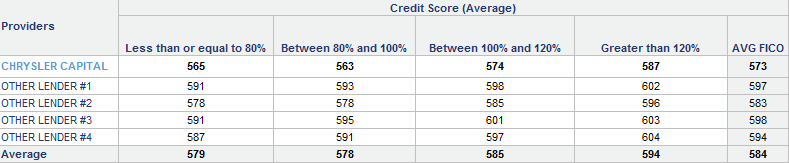

FICO distribution across loan-to-value bands shows Chrysler Capital buys the deepest FICOs of the largest subprime competitors, according to J.D. Power pin data.

Below are some best practices to help reduce fees:

- Order of applicants on contract should be listed exactly how they are listed on approval

- Down payment type (cash/trade/rebate) changes must be approved by analyst

- Confirm eligible rebates on DealerCONNECT for incentivized offers

- Frontend advance (including ALL taxes) should be included in original request

- Approved backend products and amounts should be called in to ensure no changes in rate or approved fee

- Always make sure the decision ID on callback matches the last approval in system prior to sending contract in for funding

When other lenders say no, Chrysler Capital gives you a way to go!