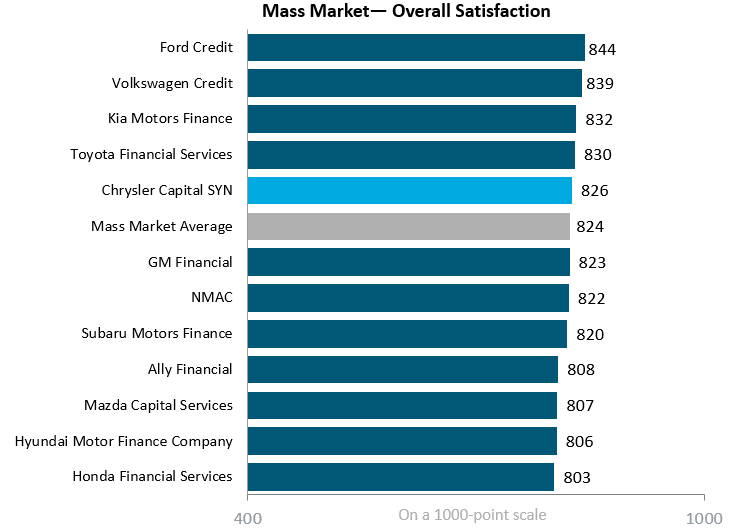

J.D. Power survey results show Chrysler Capital is above mass-market average

In June 2017, Chrysler Capital conducted a lease-end survey, via J.D. Power, to determine how we compared to the mass market captive lease providers and to identify areas of improvement or concern. J.D. Power surveyed over 10,000 Chrysler Capital customers with leases maturing between November 2016 and April 2017.

As a leading lease provider, Chrysler Capital outperformed the mass market average and was higher than both GM Financial Services and Ally.

The survey results demonstrate our continued commitment to improving our lease-end process in order to build both brand and dealer loyalty.

Highlights of the survey include:

- > Almost 60 percent of those surveyed chose to return their leased vehicle to the originating dealer and lease or purchase a new FCA US product

- > Chrysler Capital scored higher than Ally or GM Financial Services regarding customers understanding their lease-end options and in providing information on new vehicle models

- > Chrysler Capital was able to more effectively communicate via our website than competitors, thus reducing both customer frustration and servicing costs

Areas of opportunity include:

- > Continuing to work with lease-end customers to eliminate surprises on wear and tear charges

- > Better accommodating customers’ scheduling needs and educating them on their options for the inspection process

- >> While 92 percent responded that the desired time window was scheduled, only 24 percent responded that the inspections took place at their home or office