Get the most out of tax season with Chrysler Capital

Chrysler Capital is here to support you with approvals on your entire spectrum of customers. With tax season in full swing, opportunities to close incremental sales increase as consumers begin receiving their refunds.

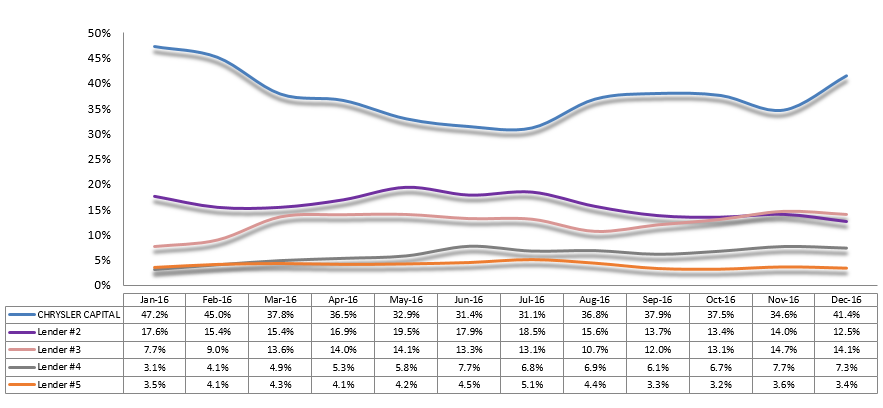

Did you know Chrysler Capital finances more FCA US products in the sub-600 FICO segment than any other lender? In 2016, Chrysler Capital financed more sub-600 FICOs than the next four lenders combined!

For tax season this year, FCA US has expanded their behind-the-scenes, subprime subvention dollars to encompass many different makes and models for customers with qualifying FICOs below 600. This additional subvention enables us to provide more competitive callbacks and lower fees, which ultimately helps you close more sales.

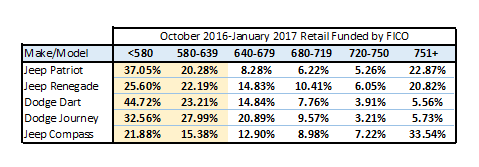

Tax season also means increased support with a particular focus on wallet-friendly vehicle lines like Dodge Dart, Dodge Journey, Jeep® Compass, Jeep Patriot and Jeep Renegade. In fact, of the thousands of vehicles Chrysler Capital finances every month, the sub-640 FICO makes up the majority of fundings on these five vehicles.

We’re also adding 500 more reasons to submit all your tax season applications to Chrysler Capital on 2017 Jeep Compass and 2017 Jeep Patriot – $500 Chrysler Capital exclusive bonus cash from Feb 1, 2017 through Feb 28, 2017. (See DealerCONNECT for program details.)

Financing credit-challenged customers through Chrysler Capital also presents additional profit opportunities with flats, participation and increased advances:

January 2017 – New retail loans funded by CCAP below 600 FICO

Average amount financed: $28,058

Average contracted rate: 14.58%

Average participation paid: $1,822

Average flat paid: $402

Keep those applications coming in this tax season!